Case Study: New PIX! Design

Background

“PIX!” is a service where the customer can purchase a betslip filled out automatically, rather than filling it out manually. In a nutshell, the betslip uses purchase data to determine popular choices so that the customer gets a betslip that is based on what customers at large think is likely, rather than a purely random betslip.

This is mainly targeted at beginners who may want to try out a new product but may not be too well versed with the details of the game mechanics or may not have the time to look into the teams and rosters of each match to confidently place bets.

Users could buy a betslip with PIX through what was internally referred to as an advert on the home page. For clarification, no external advertisement is used on the site.

Identifying UX Issues

The original design had one set price per betslip. On desktop, this meant that multiple slots on the advert widget needed to be taken up by a single product if the marketing team wanted cover the most popular price amounts. The other option shown here instead maximises the amount of product at the cost of only having one price option per product.

This led to an overcrowded advert area which was often difficult to overlook and sift through. In addition, the background images meant to inspire the user was left no room to fulfill its purpose.

On mobile, a horizontal scroll was used instead of a grid. This design was mostly good, however, the mobile advert format was not unified as both short and tall adverts existed (though never side by side), resulting in an inconsistent experience across the site. Furthermore, the previous and next adverts were given little space next to the focus advert, reducing the visibility of the horizontal scrolling feature.

From a user survey, we found the top user issues to be:

- Not finding a PIX betslip for their desired price point

- Not knowing what sport is connected to each product

- Not knowing how the different products work

The second and third issues were known site-wide issues and not specifically related to PIX. However, since PIX targets new customers, these issues were more relevant to this set of users.

Design Solutions

The design had to fullfill the following criteria:

- Be easy to overlook

- Present relevant information to the user about the product and the sport

- Be flexible and accommodating in terms of pricing

The fact of the matter was that Svenska Spel has too many products to all be shown at once. Therefore, a desktop grid of 4 was proposed. All adverts were using the taller dimensions as to give each advert room to fulfill its task, using pagination to allow the user to load more. This also meant that the adverts needed to be more appealing, or nobody would care to scroll for more.

Rather than displaying a price, these adverts instead used a short description of the product that also included which sport was being played, and also took greater care to make the background images more visible and more inspiring.

On mobile, the same format was used, but in a horisontal scroll through swiping, giving more room to the previous and next advert to increase visibility.

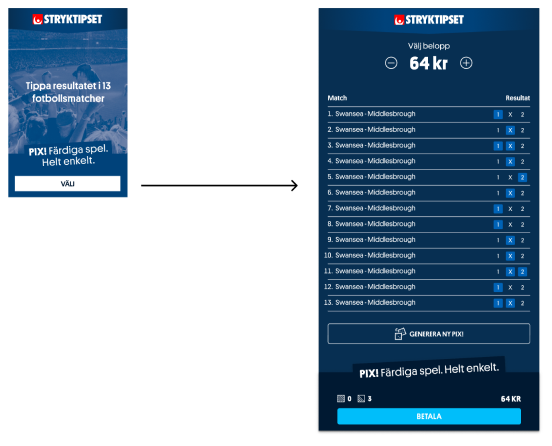

When a user clicked the “Choose” CTA button, the betslip would appear. In this stage, we added controls so that the users could select the price amount. Given the logic of the products, there were only about five price points available, each generating a different kind of betslip. Users could therefore easily navigate the different price points and immediately see how the betslip changed as they did so, giving them beginners a better understanding of the game while at the same time allowing the users themselves to decide what price was right for them.

Evaluation and Iteration

Given that PO and stakeholders felt confident with the design, we decided to use A/B testing on the production site to evaluate the design solution.

In short, the new PIX design generated 18% more advert clicks compared to the old and 5% more purchases.

One key takeaway was that while users could freely choose their own price points, a majority was happy to purchase the default option, which was usually somewhere in the middle. Products that had a higher default price point saw a revenue increase whereas product with a lower default price saw a revenue decrease. It was clear that more testing was needed to determine which price points were a good default for each product.

We also started sketching some proposals to meet customer demands in more and better ways, such as filtering the adverts based on what sport was played and personalizing the copy in the adverts based on player experience. These proposals would go into the team backlog as more tests were being done.